Wall Street is interested in the Crypto Market

There have been quite a few recent moves that show Wall Street companies are interested in the crypto market. After the market made an impressive recovery despite the not-so-positive stock market situation. Citadel Securities reported to the SEC that it invested in Silvergate Bank, which holds a 5.5% stake worth about $25 million. This is a bank that specializes in providing services to companies in the crypto market.

Wallstreet interested in Crypto

Next is the Susquehanna fund, which also reported that it bought about 2.37 million shares, or 7.5% of Silvergate’s shares (~$35 million). BlackRock also invested in additional Silvergate shares last month. The company held a 7.2% stake in Silvergate Capital as of December 31, up from 6.3% a year earlier.

Soros Fund Management purchased $39.6 million worth of convertible bonds in crypto mining company Marathon Digital Holdings. They continue to hold nearly $200 million worth of MicroStrategy stock and have a call/put option for 50,000 shares. But in contrast to the other two funds, the Soros short Silvergate Bank fund, which holds a put option worth 100,000 shares.

Macroeconomic Situation

Retail sales index reported in the past day also trended with CPI. Retail sales rose 3% in January, much higher than the Dow Jones estimate of 1.9%. This shows that the economy is still good and people are still spending normally. The index also reflects price data for many commodities that also outperformed estimates.

While people are still worried that a good economic report will lead the Fed to raise interest rates higher, they seem to be more worried about the risk of a recession. Therefore, information about the economy is still developing, so the stock market still reacted well to the reports.

For the Fed, these reported figures are not too bad and are near neutral. It is possible that the Fed will keep rates at current levels for longer rather than continue to raise rates high in its next decisions in 2023.

Many companies have started to provide crypto services

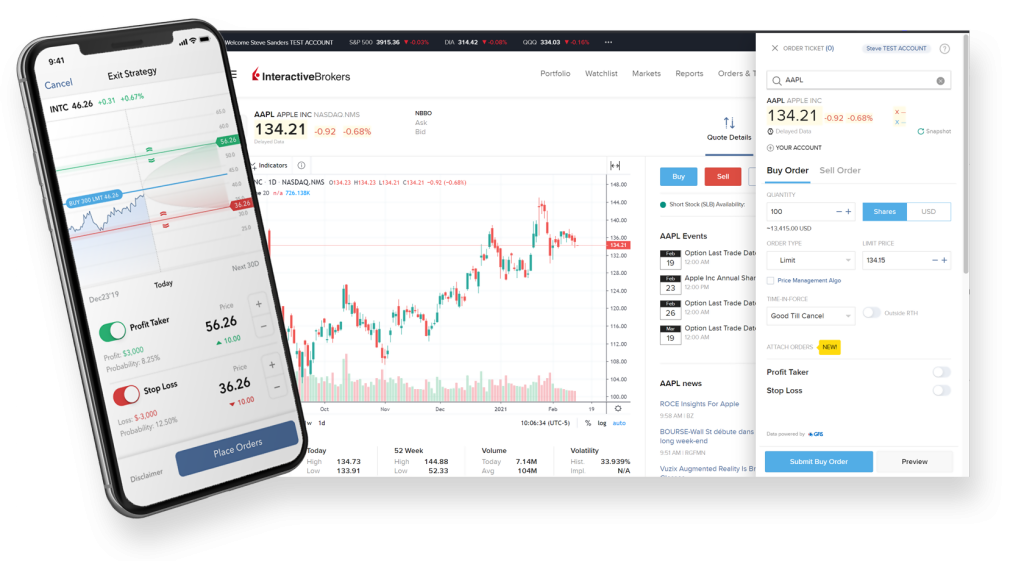

- Interactive Brokers (IBKR) has started offering cryptocurrency trading to professional investors in Hong Kong. Eligible clients can invest over HK$8 million ($1 million) and institutions with more than HK$40 million ($5 million).

- Singapore-based DBS has reported an 80% year-over-year growth in the number of Bitcoin (BTC) traded on Digital Exchanges DBS (DDEx) in 2022. According to the report, in 2022, the amount of Ether (ETH) traded on DDEx is nearly 65% higher. Although 2022 is a bear market year, the DBS report still shows interest in crypto from major investors.

- Abu Dhabi’s technology ecosystem, Hub71, has announced a new initiative called “Hub71+ Digital Assets” with over $2 billion in funding to attract web3 related companies. This project aims to promote Web3-based innovations, such as blockchain technology and metaverse applications. It aspires to provide Web3 startups with access to a wide range of programs and initiatives, as well as corporate, government and investment partners in both global and UAE markets.

- Wirex, a leading crypto payments platform, has announced a long-term strategic partnership with payments giant Visa to expand its footprint in the UK and the Asia-Thai region. Binh Duong (APAC). With the partnership, Wirex will directly issue crypto-enabled debit cards and prepaid cards for assets like Bitcoin (BTC) to more than 40 countries.

- India has taken a more positive stance on crypto. India’s Finance Minister Nirmala Sitharaman also said that a single country making laws would not work because it is an unstoppable technology market. Therefore, she is considering discussing with other countries in the G20 meeting to discuss and consider making a common law on this market.