Bitcoin and US Stock Market Correlation is not the same during the crypto winter period.

Bitcoin remains sideways around $24,000 while altcoins grow strongly. The correlation of BTC and US stocks is not continuous because the groups of investors who invest in both stocks and crypto change from time to time in the market. Especially when the crypto market goes into winter, stock investors will leave the market. At that time, the correlation of the two markets at this time is often greatly reduced. Even when compared to the S&P500 index, which is a group of technology stocks, there is no similarity in growth.

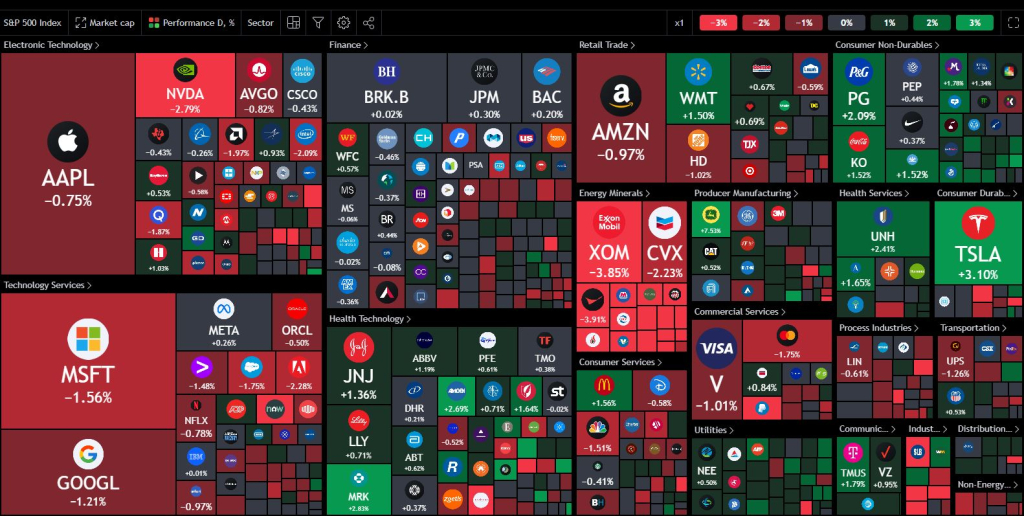

SP500 index

Crypto price

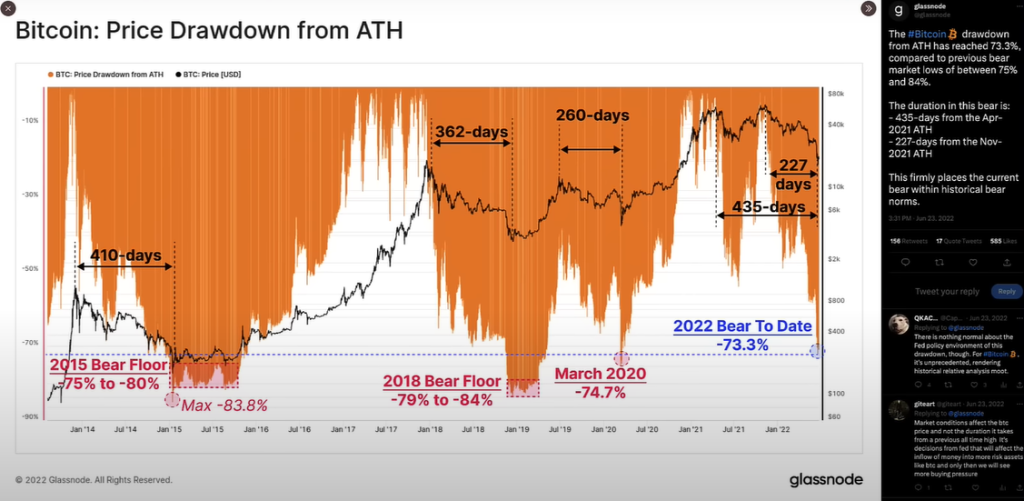

The statistics of BTC’s strongest decline before rebounding in previous bull seasons are quite different so Bitcoin and US Stock Market Correlation is not continues. Like in 2013, 2015 and 2018, BTC price dropped 93%, 84%, 84%. Based on this information, many people think that BTC will drop from the peak to the price of 10,000 USD equivalent to an 84% decrease. The reason is because the last time the BTC price dropped to $15,000 was only 77% from the peak. Many investors think that maybe the price of 15,000 USD is already the lowest price of this cycle. Without black swan events like 3AC, Terra or FTX, the bottom price could be higher than $15,000.

Glassnode insight

Glassnode also provides statistics on how long BTC has been in bear season in each of the previous six-month cycles. Statistics show that the bear season in 2015 is 410 days, 2018 is 362 days and 2020 is 262 days. The BTC drop in 2022 so far has fallen on 447 days. This may have been the longest bear season.

Price Drawdown from ATH

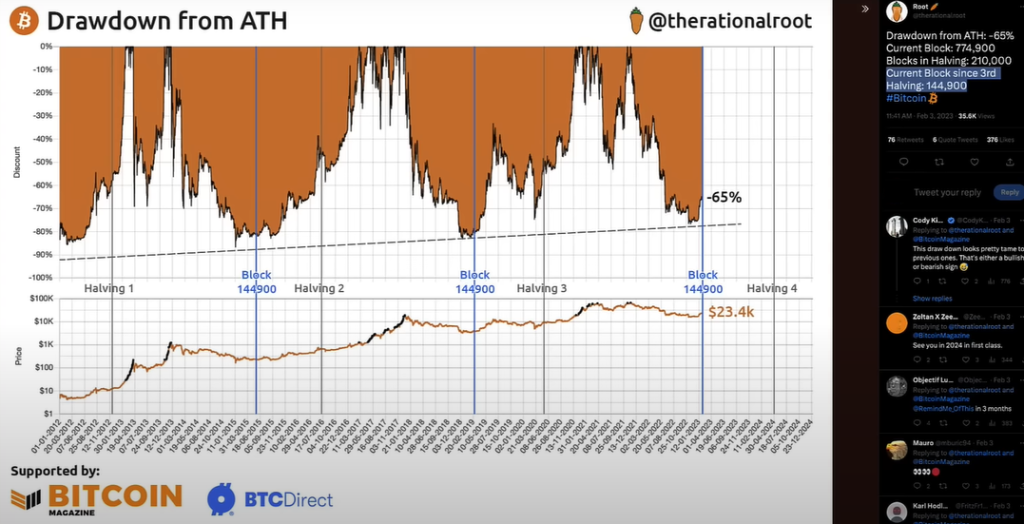

If we look at the block of each halving then if BTC is similar to history, we may have seen the bottom of this wave and the price is starting to go into a recovery.

Price recovering

Five key economic points from President Biden’s in 2023

First, he called for taxing billionaires and taxing companies when they buy back shares. He said the companies make a lot of profit but pay almost zero federal taxes. So that’s not fair. However, these companies pay taxes differently, and they do pay state taxes, not federal taxes. President Biden previously proposed a 20% tax on billionaires last March as part of his federal budget. But this proposal did not attract much attention and was unlikely to be approved.

In addition, President Biden has also announced that he will not raise taxes on Americans earning less than $400,000 a year. In fact, people with low incomes are the ones who are more likely to give in and pay taxes to the tax office. Because the rich have high incomes, they are willing to pay to protest against the tax department when there are moves to increase taxes.

The problems that are happening in the United States

- Second, President Biden talked about campaigning against unnecessary “junk costs” from banks, airlines, cable companies and other industries. He continues to campaign against unnecessary “junk costs” from banks, airlines, cable companies and other industries, which add unexpected costs to consumers’ bills. He called on Congress to pass the Garbage Charges Prevention Act, which would impose further restrictions on excessive fees charged to travel and event tickets.

- Third, he said that capitalism without competition is not capitalism, it is blackmail. One company recently implicated is Google, which has been sued for antitrust laws. They have almost a monopoly in the search browser and own Youtube, the most popular platforms. So many people question that Google is too monopolistic and needs to split up to reduce this.

- Fourth, the president called on workers to be entitled to paid leave and affordable childcare support, and that companies must allow unions. This will cause businesses to pay more costs related to employees and affect the company. Unions have been a controversial factor for many years in the United States, and many consider it bad for the company.

- Finally, pharmaceutical companies must provide insulin for diabetes at a reasonable price. The president called for extending the $35 price cap on insulin passed in the Medicare Inflation Act to Americans in need of private insurance.

In general, the things mentioned by President Biden are problems that are happening in the United States. These are issues that have been raised many times but have failed. What President Biden shared about his desire but did not have a detailed plan to make it possible. Because it needs to be approved by both parties and parliament before it can be applied.